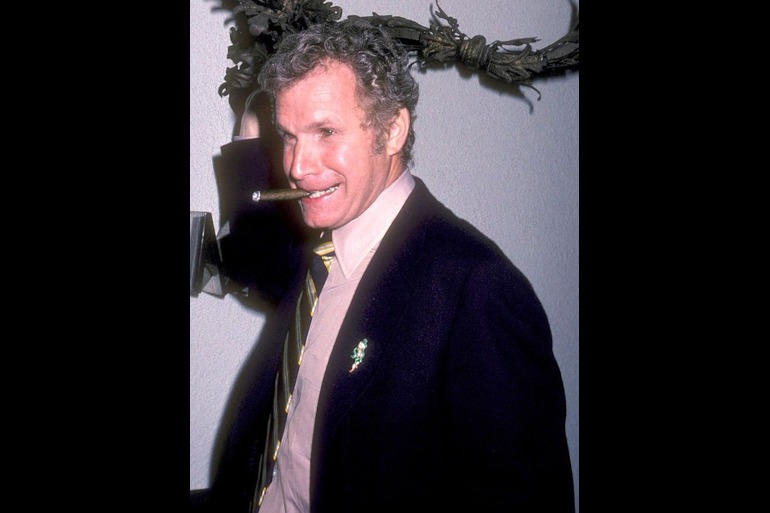

Wayne Rogers’ net worth was a consensus $75 million at his death in 2015. This figure translates to approximately $99.8 million in 2025 dollars [1, 5]. These numbers are supported by obituaries, financial reports, and inflation data, confirming his wealth came from business deals, not acting checks.

| Fact | Detail |

|---|---|

| Name | Wayne Rogers |

| Net Worth (2015) | $75,000,000 |

| 2025 Equivalent | ~$99,800,000 |

| Primary Wealth Sources | Investments, Real Estate, Banking, Business |

| Notable Roles | ‘Trapper John’ on M*A*S*H, Financial Panelist |

Key Takeaways

- Net Worth in 2025: Wayne Rogers’ 2015 net worth of $75 million is equivalent to approximately $99.8 million in 2025 dollars when adjusted for inflation.

- Investments > Acting: The vast majority of his fortune came from his investment firm, real estate ventures, and banking, not his M*A*S*H salary.

- #1 Among M*A*S*H Cast: He was the wealthiest member of the M*A*S*H cast by a significant margin, due to his second career in business.

Fast Answer: Wayne Rogers Net Worth in 2025 Dollars

Wayne Rogers’ net worth at his death in 2015 was $75 million, which is about $99.8 million in 2025 U.S. dollars [1, 5], a substantial sum, though modest compared to the top names on the celebrity rich list 2025.

While $75 million is the consensus figure, a minority of sources cite an estimate around $102 million (£75m at the time) ^(1). His wealth was driven almost entirely by decades of strategic investing after he left acting.

| Wayne Rogers Net Worth , Quick Facts | |

|---|---|

| Net worth at death (2015) | $75,000,000 (primary consensus) ^(1) |

| 2025 equivalent (CPI-adjusted) | ~$99,800,000 ^(5) |

| Range seen online | $75M–$102M ^(1) |

| Primary wealth driver | Investments and real estate ^(2) |

M*A*S*H vs. Investments: The Real Wealth Breakdown

Most people remember him from M*A*S*H, but acting was just his seed capital. The real money came from building and owning assets.

| Estimated Earnings Mix | Role/Notes | Share of Net Worth |

|---|---|---|

| M*A*S*H Salary/Residuals | 3 seasons only (1972-1975) ^(3) | Minor |

| Other Acting/TV | “House Calls,” guest roles ^(4) | Minor |

| Investments/Businesses | Founded Wayne Rogers & Co. ^(2) | Primary |

| Real Estate | Multi-state residential & commercial ^(2) | Primary |

| Banking | Founder of two community banks ^(2) | Meaningful |

| Sports Ownership | Partial stake in Oakland A’s ^(4) | Meaningful |

| Board Roles | Vishay Intertechnology, Kleinfeld ^(2) | Meaningful |

| Media Commentary | Fox Business panelist, “Cashin’ In” ^(4) | Meaningful |

- He left M*A*S*H after only three seasons, limiting his share of the show’s long-term syndication profits ^(3).

- The bulk of his wealth was generated through his investment firm, real estate development, and founding multiple businesses ^(2).

- His hands-on management style and focus on value investing allowed his wealth to compound over decades.

M*A*S*H Pay and Residuals (1972–1975)

Rogers played Captain “Trapper” John McIntyre from 1972 to 1975. He left after the third season over contract disputes and his character being secondary to Alan Alda’s “Hawkeye” Pierce ^(3). His acting salary provided the initial capital for his pivot to business, but it was not the source of his large fortune. It seems he was more interested in playing the stock market than playing a doctor.

- By leaving early, he missed out on the salary increases and profit participation deals that came in later seasons.

- While he likely received some syndication residuals, this income was a small piece of his overall financial picture.

- Rogers felt the producers were violating his contract by forcing him to sign a “morals clause,” which contributed to his decision to exit the show ^(3).

The Investments and Businesses That Built His Fortune

This is where the story of the Wayne Rogers net worth begins. He built an empire off-screen.

Wayne Rogers & Co. (Investment Firm)

Shortly after M*A*S*H, he founded his own investment management firm, Wayne Rogers & Co. He managed his own money and assets for other high-net-worth individuals, including actor Peter Falk [1, 2]. The firm’s initial capital investment and specific fee structure are not public. Investment management firms of that era typically charged asset under management (AUM) fees ranging from 0.5% to 2%.

Board and Operating Roles

Rogers took active roles in the companies he invested in.

- Vishay Intertechnology: He served on the board of this Fortune 1000 electronics manufacturer ^(2).

- Kleinfeld Bridal & Stop-N-Save: He was chairman of Kleinfeld, the bridal retailer, and CEO/chairman of the Stop-N-Save convenience store chain ^(2).

Specific compensation details, such as annual salary, bonuses, or stock options from his board roles at Vishay Intertechnology, Kleinfeld, and other companies, were not publicly disclosed.

Banking Ventures

He was a founder of Plaza Bank of Commerce in San Jose, CA, which was later acquired by Comerica ^(2). He also founded and was marketing director for Premier Community Bank in Florida [2, 4]. The exact financial terms and his equity stakes in these two banks are not available in public records.

Sports Ownership

He held a partial stake in the MLB’s Oakland Athletics through his partnership with developer Lewis Wolff ^(2). His ownership was a minority position, and the exact percentage and total investment amount are not public information.

Media & Financial Commentary

For years, Rogers was a panelist on the Fox Business Network show “Cashin’ In” ^(1). This role established his credibility as a financial expert and provided a platform to discuss finance ^(4).

Real Estate Holdings: A Key to His Wealth Growth

Real estate was a cornerstone of his investment strategy. He developed and owned a portfolio of residential and commercial projects across states like California, Florida, Arizona, New Mexico, and Utah ^(2).

A key project was Willow Creek Plantation in Crestview, FL, a housing community designed to serve more than 5,000 military personnel and their families. It featured amenities specific to that demographic ^(2).

- His strategy focused on generating rental cash flow while benefiting from long-term property appreciation.

- Project costs, investment timelines, and the specific equity structures for his real estate developments are not publicly available.

Net Worth Timeline: Selected Milestones

His wealth was the result of strategic moves made over 40 years. These ventures built his wealth over time.

| Wealth Milestones | |

|---|---|

| 1972–1975 | Earned seed capital from M*A*S*H seasons 1–3. |

| Late 1970s–1980s | Built his investment firm and began real estate investments. |

| 1990s | Expanded into banking and took on high-profile board roles. |

| 2001 | Established residency in Florida for tax benefits ^(4). |

| 2015 | Died at age 82 with a net worth estimated at ~$75 million ^(1). |

| 2025 | The inflation-adjusted value of his estate is ~$99.8 million ^(5). |

Where Wayne Rogers Ranks Among M*A*S*H Co-Stars (2025 View)

His business acumen, which set him apart from most acting peers on any list of celebrities by net worth, put him far ahead of his co-stars, whose wealth was primarily from their acting careers.

| M*A*S*H Cast Net Worths (approx., 2025 dollars) | |

|---|---|

| Wayne Rogers | ~$100 Million (at death, inflation-adjusted) [1, 5] |

| Alan Alda | ~$50 Million ^(1) |

| Harry Morgan | ~$14 Million (at death, inflation-adjusted) ^(1) |

| McLean Stevenson | ~$4 Million (at death, inflation-adjusted) ^(1) |

| (Note: Figures are best-available estimates from public sources and adjusted for inflation where applicable.) |

Investment Approach in Plain English (Why It Worked)

Rogers followed a set of simple rules.

- Buy Smart: He bought quality assets that produced cash, often when they were out of favor or distressed.

- Diversify: He spread his money across different industries (real estate, banking, retail, sports) and geographies ^(2).

- Manage Directly: He took active roles to control outcomes and keep management fees low after seeing other actors lose money to poor managers ^(2).

- Be Patient: He held assets for the long term, reinvesting profits to let compound growth work.

He was a critic of Wall Street’s complexity, testifying before Congress on banking regulations and arguing for simpler financial systems [1, 4].

Estate, Residency, and Legacy

Rogers moved to Destin, Florida in 2001, a decision likely made to use the state’s lack of income tax and favorable estate laws ^(4).

He was survived by his wife, Amy Hirsh, and two children from his first marriage ^(1). His community involvement in Florida included support for organizations like the Emerald Coast Children’s Advocacy Center and Alaqua Animal Refuge ^(4).

Wayne Rogers died on December 31, 2015, at age 82 from pneumonia complications ^(4). His estate appears structured to preserve his wealth and continue his philanthropic goals.

FAQs

1. How much was Wayne Rogers worth when he died?

Wayne Rogers’ net worth was a consensus $75 million at the time of his death on December 31, 2015 ^(1).

2. Were Wayne Rogers and Alan Alda friends?

Public records and interviews primarily focus on their professional relationship. Details of their personal friendship are not widely documented.

3. What is Alan Alda’s net worth?

As of 2025, Alan Alda’s net worth is estimated to be around $50 million ^(1).

4. How did Wayne Rogers make his money?

The majority of his wealth came from investments. He founded an investment firm, developed a large real estate portfolio, started two banks, and held leadership roles in several companies ^(2).

Check Out: Bobby Lytes Net Worth 2025